Baltic startups raised €516M as of September 1, 2023

|

In 2021 and 2022, the total VC funding in this region was over €4B, more than all previous years combined (starting from 2018). From the second half of 2022 until the end of the first half of 2023, Baltic startups have raised over €800M at early (up to €15M) stages and breakout stages (€15M-€100M) of investment.

In the Baltics, approximately 30% of early-stage VC funding (up to €40M) was made by local investors in the first six months of 2023. In 2022, it was 23%. In H1 2023, 33% of late-stage funding (€40M and more) was made by local investors, and in 2022 - only 11%.

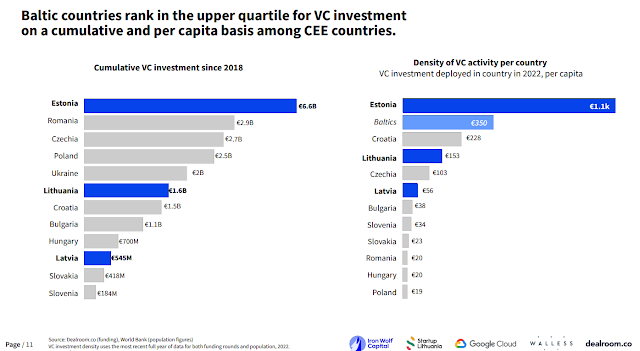

Baltic countries are leading in the list of venture investments on cumulative and per capita among Central and Eastern European countries. Since 2018, cumulative VC investment in Estonia was €6,6B, Lithuania aggregated €1,6B, and Latvia - €545M.

VC investment deployed in Estonia per capita in 2022 was €1,1K, in Lithuania - €153, in Latvia - €56, and on average in the Baltics - €350.

Since 2022, there have been 400 investment rounds in the Baltics. Fintech startups raised 84 investment rounds over the past 18 months. Transportation - 45, and energy startups - 41. In the first six months of 2023, there were 18 rounds with fintech companies, 18 - with transport, and 18 - with energy startups.

In H1 2023, energy startups raised €171M, security €160M, transport - €78M, fintech - €47M, and food tech - €10M. During 2022, energy startups raised €125M, transport - €815M, and security - €223M.

According to the report, Baltic deep tech is one of the fastest-growing sectors in Europe. From 2018 till H1 2023, the deep tech ecosystem has grown 4,2 times. In the US, it grew four times, and in the EU - 3,6 times. The combined enterprise value of deep tech startups in Estonia was €26,8B, in Lithuania - €13,2B, and in Latvia - €3,2B.

In 2023, 18% of investment (€94M) was made into deep tech startups, 53% (€274M) - into AI startups, and 29% - into the rest areas. Among the significant impact and climate tech rounds were Lithuanian PVCase, which raised €100M at the early stage, Estonian SaaS solution for agricultural land management eAgronom (€12,9M in the A-series round), and Tallinn-base electric cargo bike developer Vok Bike (€3,8M in the seed round). Among significant deep tech rounds was an Estonian developer of supercapacitors Skeleton Technologies (€55M).

According to the report, among the promising Baltic unicorns could be the Estonian avatar platform for creating virtual identities Ready Player Me, option-focused trading platform Bittlevex, Lithuanian fintech Kevin, developer of solar project design software PvCase, Latvian cleaning robots technology Squad Robotics, a print-on-demand and dropshipping platform Printify, and few more technological companies.

Iron Wolf Capital's and Dealroom.co's report comprises startups, launched by Baltic founders. Some of them scaled later and moved their headquarters abroad. Among these companies are money transfer service Wise, which is based in London, identity network company Id.me, which is based in the US, translation management system Lokalise, which is also based in the US, and others. The report was supported by governmental organization Startup Lithuania, infrastructure for cloud computing Google Cloud, and Baltic law firm Walless.