Investments in Baltic startups grew by 82% in the first half of 2024

According to the Baltic startup funding report prepared by Lithuanian accelerator and venture capitalist Firstpick and Estonian Change Ventures, investments in Baltic startups grew by 82% in the first half of the year. Startups in the Baltics have raised €349.1M in H1 2024, comparing to H1 2023 when Baltic startups raised €192.3M.

Estonians are ahead of Latvia and Lithuania in both investment rounds and valuations of early-stage (seed) startups. For Series A and growth rounds in the first half of 2024, Estonian startups have raised more than half (9) of the number of rounds (13) closed in 2023.

At the same time, Lithuanian and Latvian startups have raised pre-seed investments at valuations about 30% higher than startups in Estonia. The report attributes this to the large number of AI startups, especially in Lithuania, which raised rounds at particularly high valuations.

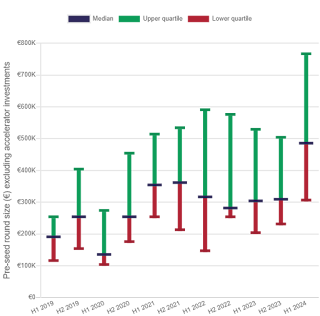

In the Baltics, the number of pre-seed investment rounds fell to 32 deals but the average investment size increased, doubling to nearly €500K, compared to the second half of 2023. The average seed round amount fell from around €2M to €1.5M. The report attributes this to an increase in bridge and expansion rounds as startups aim to survive longer before raising Series A.There were only 10 A-rounds in the last 12 months, compared to 25 in the same period in 2022. As for growth rounds, their volume in the first six months of 2024 exceeded the volume of growth rounds in the period from the second half of 2022 till the first half of 2023, indicating a return of growth capital.

In the first half of 2024, the median pre-seed valuation increased to €3.5M for pre-seed startups. The median seed round valuation nearly halved since last year, from around €12M to less than €7M.

Firstpick is a venture capital firm and accelerator established by ex-Lithuanian team of Estonian accelerator StartupWiseGuys. The size of the fund is €20M. The initial ticket starts at €50-€200K. The partners of Firstpick are Jonė Vaitulevičiūtė, Marijus Andrijauskas, Andra Bagdonaite.

.png)